There seems to be some confusion in certain circles about the meaning of fungibility with regard to blockchain technology. I will try to clear that up.

Fungibility does not mean that one can exchange a crypto unit from one blockchain with another. One bitcoin does not equal one litecoin. That doesn’t mean that one can’t be traded for another, but the trade is simply that—a trade.

Blockchain technology is a wonderful thing, but it has its limitations. As long as we all agree on that, we can have great discussions. But I’ll draw an analogy between the blockchain and a field. When a farmer plows his field and readies it for a new crop, he doesn’t consider the field to be his product. Whether he plants corn, soybeans, or wheat, those are his products.

With regard to fungibility, one could take an ear of corn from the farmer’s harvest, take it to another man’s farm, and trade it for another ear of corn. Same product, same value. The corn is not fungible with soybeans, but the farmer could trade some corn for an equal value of soybeans. Cryptocurrencies are similar to these farming products.

Bitcoin has its own blockchain. On that blockchain, there is one crop: Bitcoin. Ethereum, on the other hand, has many crops—called altcoins. ERC-20 tokens. Ethereum is the primary crop, but there are a variety of tokens minted on the same chain. None of them are fungible with bitcoin, nor are they fungible with each other. They can be traded, but the essence of fungibility is that you can take any one of those ERC-20 tokens and trade it for another of the same ERC-20 token because they have the same value.

This basic feature of blockchain technology, the ability to mint cryptocurrencies that are not fungible with each other but are fungible with the same cryptocurrency minted on the same blockchain, is embedded in the technology. It’s not a bug.

This feature is the reason both the SEC and CFTC chairs consider bitcoin and ether to both be commodities. They act like commodities. Therefore, they are commodities. I believe the law will soon recognize that.

Now For Some Crypto News

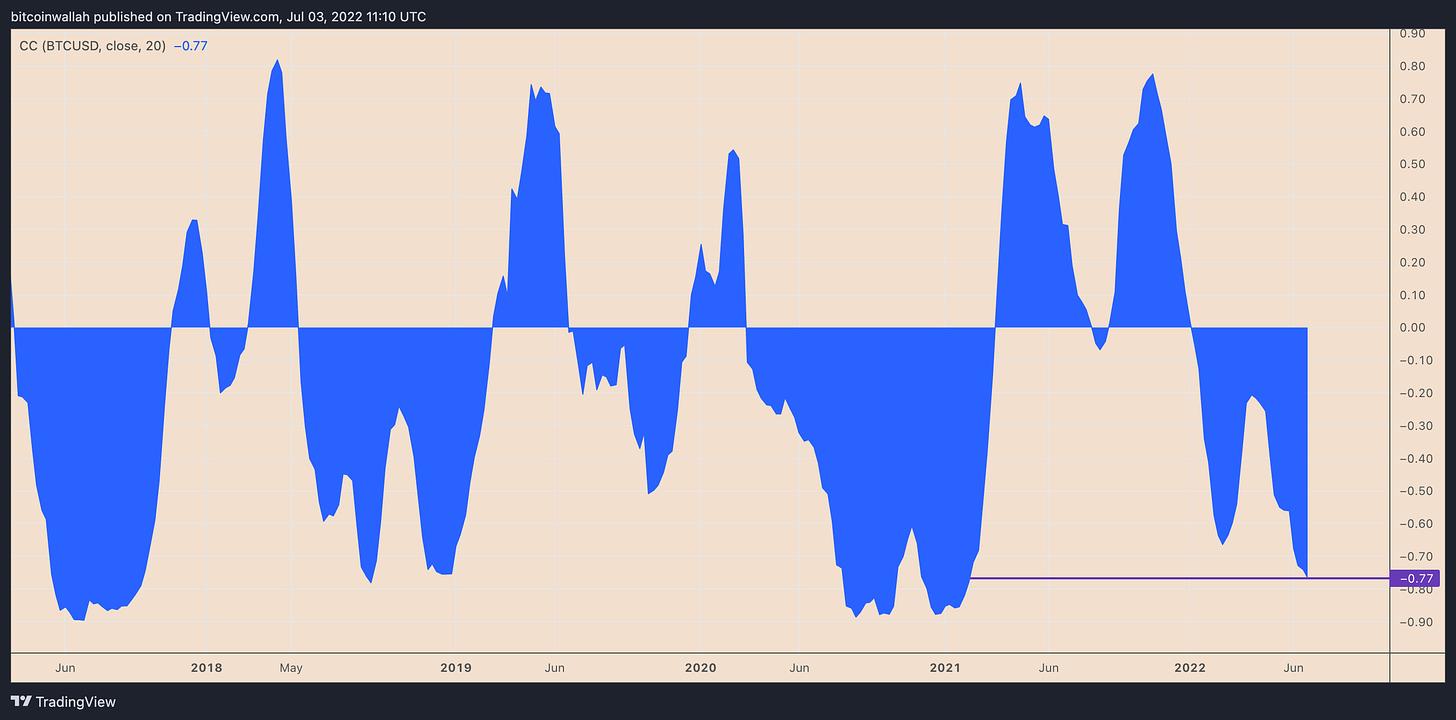

Upside down bitcoin addresses are at an all-time high. Just as well, BTC’s inverse correlation with the U.S. dollar is at a 17-month high. Black Swan author says bitcoin will be a failure even if it soars to $100,000. What is a bitcoin mixer and how does it work? There are a lot of HODLers. They may be upside down today, but when bitcoin rises again, they will be made right. They only lose when they cash out.

Ethereum’s average gas fees have declined to their lowest since 2020. Meanwhile, the opportunity cost of ETH 2.0 deposits hit an all-time high.

Binance found 1 billion resident records for sale on the dark web.

Coinbase is expanding its European footprint, and freezing all hiring plans this year.

Former Securities and Exchange Commission Chief Robert Cohen says Ripple doesn’t stand a chance against SEC. In essence, he’s saying if Ripple wins, then the SEC will appeal. Personally, I could see it going all the way to the Supreme Court. Ripple did recently receive a boost with a major win.

Data shows USDT has a liquidity imbalance. Tether is so unstable it’s headed for a psych ward.

The U.S. and the UK are teaming up to address crypto regulation. Crypto is a global phenomenon. If the international banking system expects to get a handle on the revolution, they’ll have to collude across national boundaries.

KuCoin Cofounder Lyu says everything is going well. Should we believe him? Here’s a thoughtful read on KuCoin.

Celsius has laid off a quarter of its workforce.

Huobi is also laying off employees, and the owner may sell stake.

It’s July 4 in the U.S. Declare you monetary freedom. (A MUST-READ) There can be no freedom without monetary freedom. That’s why I would extend the call to freedom beyond bitcoin to all cryptocurrencies. That doesn’t mean that all crypto is created equal, nor does it mean that all cryptocurrencies have the same value. But choice in the monetary market is the best way to ensure that freedom wins long term, and not just in America.

GPU prices have fallen 57 percent since January. This correlates quite nicely with Ethereum profits.

Crypto is good for gambling, but makes for lousy currency. Past market behavior is no indication of the future.

Cryptosocial media upstart Bastyon has got a little bit of national exposure. Here’s an interview with its founder. Worth your while to watch.

Cybersquatters have moved into Web3.

How the bear market is an opportunity for realignment.

Expiring copyrights could turn NFTs into a goldmine. Why some NFT drops are more successful than others. Should the good faith doctrine apply to NFTs? Funny man Bill Murray is jumping on the NFT bandwagon, and does he have stories to tell.

Dr. Craig Wright, aka self-proclaimed Satoshi Nakamoto, sees a day when Bitcoin SV will process 10 billion transactions per second.

There is too much centralization in DeFi.

The British Army’s Twitter and YouTube accounts were hacked. The hackers spread crypto spam far and wide.

Russia approves VAT exemption for digital currency issuers.

Kuwaiti Islamic Bank Warba Bank enters the metaverse.

For my U.S. readers, Happy July 4th! May your day be bright and sunny.

Snark and commentary in italics. Financial advice non-existent. Do your own research and quit listening to prophets.

Cryptocracy is a decentralized newsletter published several times a week. I curate the latest news and crypto analysis from some of the brightest minds in crypto, and sometimes offer a little insightful and snarky commentary. Always fresh, always interesting, and always crypto.

First published at Cryptocracy. Not to be construed as financial advice.